This function produces h-step ahead forecasts of both the factors and the data, with an option to also forecast autocorrelated residuals with a univariate method and produce a combined forecast.

Usage

# S3 method for class 'dfm'

predict(

object,

h = 10L,

method = switch(object$em.method, none = "2s", "qml"),

standardized = TRUE,

resFUN = NULL,

resAC = 0.1,

...

)

# S3 method for class 'dfm_forecast'

print(x, digits = 4L, ...)

# S3 method for class 'dfm_forecast'

plot(

x,

main = paste(x$h, "Period Ahead DFM Forecast"),

xlab = "Time",

ylab = "Standardized Data",

factors = seq_len(ncol(x$F)),

scale.factors = TRUE,

factor.col = rainbow(length(factors)),

factor.lwd = 1.5,

fcst.lty = "dashed",

data.col = c("grey85", "grey65"),

legend = TRUE,

legend.items = paste0("f", factors),

grid = FALSE,

vline = TRUE,

vline.lty = "dotted",

vline.col = "black",

...

)

# S3 method for class 'dfm_forecast'

as.data.frame(

x,

...,

use = c("factors", "data", "both"),

pivot = c("long", "wide"),

time = seq_len(nrow(x$F) + x$h),

stringsAsFactors = TRUE

)Arguments

- object

an object of class 'dfm'.

- h

integer. The forecast horizon.

- method

character. The factor estimates to use: one of

"qml","2s"or"pca".- standardized

logical.

FALSEwill return data forecasts on the original scale.- resFUN

an (optional) function to compute a univariate forecast of the residuals. The function needs to have a second argument providing the forecast horizon (

h) and return a vector of forecasts. See Examples.- resAC

numeric. Threshold for residual autocorrelation to apply

resFUN: only residual series where AC1 > resAC will be forecasted.- ...

not used.

- x

an object class 'dfm_forecast'.

- digits

integer. The number of digits to print out.

- main, xlab, ylab

character. Graphical parameters passed to

ts.plot.- factors

integers indicating which factors to display. Setting this to

NA,NULLor0will omit factor plots.- scale.factors

logical. Standardize factor estimates, this usually improves the plot since the factor estimates corresponding to the greatest PCA eigenvalues tend to have a greater variance than the data.

- factor.col, factor.lwd

graphical parameters affecting the colour and line width of factor estimates plots. See

par.- fcst.lty

integer or character giving the line type of the forecasts of factors and data. See

par.- data.col

character vector of length 2 indicating the colours of historical data and forecasts of that data. Setting this to

NA,NULLor""will not plot data and data forecasts.- legend

logical.

TRUEdraws a legend in the top-left of the chart.- legend.items

character names of factors for the legend.

- grid

logical.

TRUEdraws a grid on the background of the plot.- vline

logical.

TRUEdraws a vertical line deliminating historical data and forecasts.- vline.lty, vline.col

graphical parameters affecting the appearance of the vertical line. See

par.- use

character. Which forecasts to use

"factors","data"or"both".- pivot

character. The orientation of the frame:

"long"or"wide".- time

a vector identifying the time dimension, must be of length T + h, or

NULLto omit a time variable.- stringsAsFactors

logical. If

TRUEandpivot = "long"the 'Variable' column is created as a factor. Same as option toas.data.frame.table.

Value

A list-like object of class 'dfm_forecast' with the following elements:

X_fcst\(h \times n\) matrix with the forecasts of the variables.

F_fcst\(h \times r\) matrix with the factor forecasts.

X\(T \times n\) matrix with the standardized (scaled and centered) data - with attributes attached allowing reconstruction of the original data:

"stats"is a \(n \times 5\) matrix of summary statistics of class "qsu"(seeqsu). Only attached ifstandardized = TRUE."attributes"contains the attributesof the original data input."is.list"is a logical value indicating whether the original data input was a list / data frame. F\(T \times r\) matrix of factor estimates.

methodthe factor estimation method used.

anyNAlogical indicating whether

Xcontains any missing values.hthe forecast horizon.

resid.fclogical indicating whether a univariate forecasting function was applied to the residuals.

resid.fc.indindices indicating for which variables (columns of

X) the residuals were forecasted using the univariate function.callcall object obtained from

match.call().

Examples

# \donttest{

library(xts)

library(collapse)

# Fit DFM with 3 factors and 3 lags in the transition equation

mod <- DFM(diff(BM14_M), r = 3, p = 3)

#> Converged after 26 iterations.

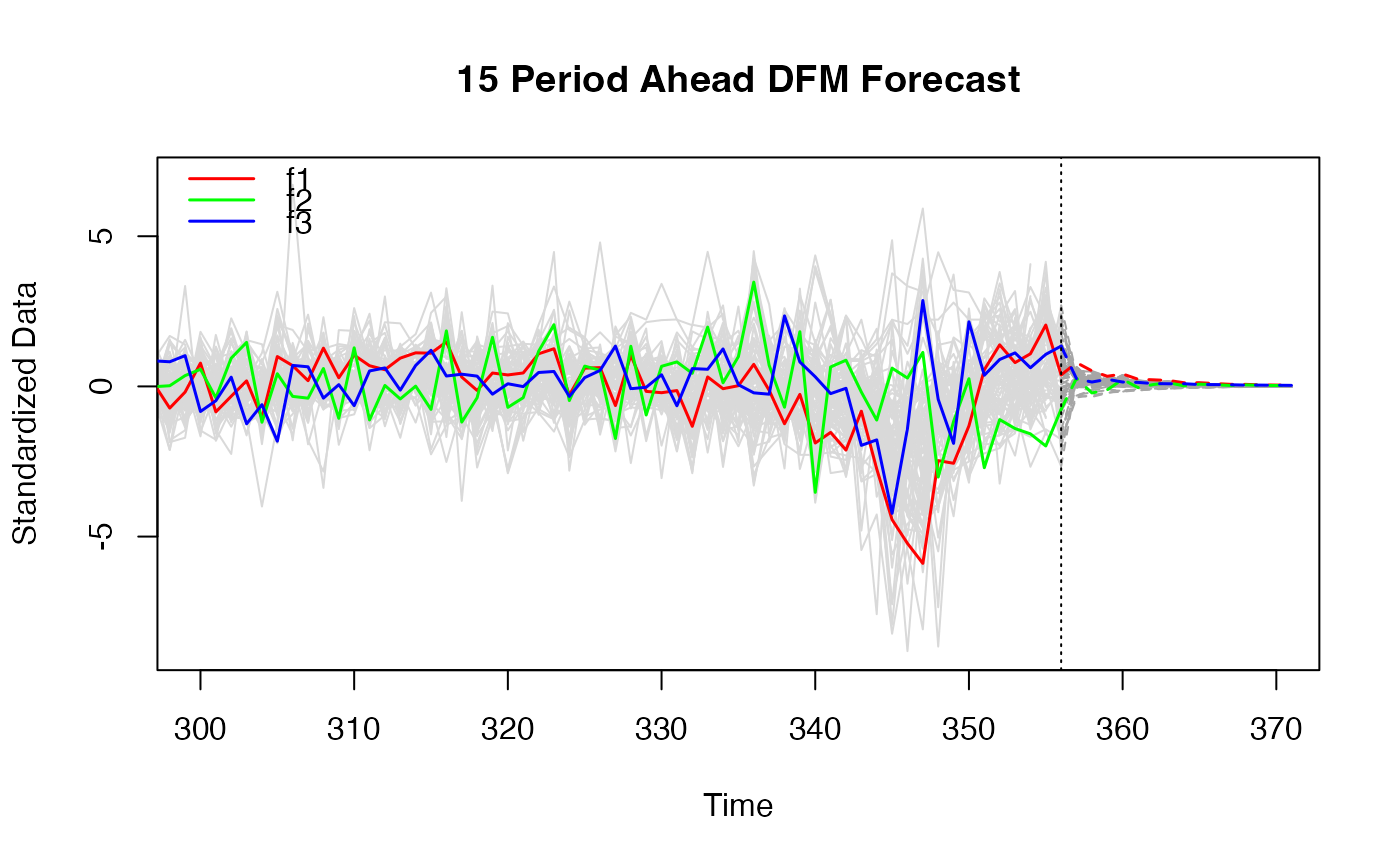

# 15 period ahead forecast

fc <- predict(mod, h = 15)

print(fc)

#> 15 Step Ahead Forecast from Dynamic Factor Model

#>

#> Factor Forecasts

#> f1 f2 f3

#> 1 2.9621 0.6302 0.5202

#> 2 1.9067 -0.5821 0.2764

#> 3 1.2112 -0.3266 0.4844

#> 4 1.5063 0.5408 0.2756

#> 5 0.8329 -0.1443 0.2490

#> 6 0.7555 0.1133 0.1586

#> 7 0.6686 0.2544 0.1433

#> 8 0.3800 0.0005 0.1455

#> 9 0.3847 0.1413 0.0843

#> 10 0.2774 0.1007 0.0806

#> 11 0.1773 0.0345 0.0700

#> 12 0.1725 0.0851 0.0445

#> 13 0.1093 0.0398 0.0419

#> 14 0.0802 0.0305 0.0313

#> 15 0.0701 0.0400 0.0220

#>

#> Series Forecasts

#> ip_total ip_tot_cstr ip_tot_cstr_en ip_constr ip_im_goods ip_capital

#> 1 0.6138 0.6115 0.6460 0.1651 0.5878 0.5235

#> 2 0.1876 0.2603 0.1876 0.0448 0.2593 0.1359

#> 3 0.1144 0.1749 0.1158 0.0167 0.1507 0.0915

#> 4 0.3585 0.3407 0.3795 0.0978 0.3256 0.3111

#> 5 0.0995 0.1300 0.1020 0.0207 0.1189 0.0803

#> 6 0.1453 0.1499 0.1525 0.0378 0.1424 0.1235

#> 7 0.1612 0.1534 0.1709 0.0433 0.1450 0.1408

#> 8 0.0581 0.0686 0.0607 0.0122 0.0605 0.0498

#> 9 0.0916 0.0876 0.0971 0.0245 0.0827 0.0799

#> 10 0.0649 0.0632 0.0689 0.0167 0.0582 0.0572

#> 11 0.0343 0.0366 0.0362 0.0078 0.0323 0.0302

#> 12 0.0454 0.0423 0.0483 0.0121 0.0393 0.0402

#> 13 0.0252 0.0251 0.0267 0.0061 0.0223 0.0224

#> 14 0.0187 0.0186 0.0199 0.0045 0.0165 0.0167

#> 15 0.0194 0.0180 0.0207 0.0051 0.0164 0.0174

#> ip_d_cstr ip_nd_cons ip_en ip_en_2 ip_manuf ip_metals ip_chemicals

#> 1 0.4291 0.3596 0.0360 0.0535 0.6513 0.4595 0.3989

#> 2 0.1012 0.0550 0.0467 0.0330 0.1977 0.2219 0.1742

#> 3 0.0541 0.0275 0.0476 0.0321 0.1225 0.1462 0.0992

#> 4 0.2574 0.2223 0.0129 0.0274 0.3807 0.2501 0.2213

#> 5 0.0566 0.0376 0.0253 0.0190 0.1059 0.1060 0.0793

#> 6 0.0994 0.0818 0.0121 0.0146 0.1543 0.1138 0.0963

#> 7 0.1156 0.1002 0.0066 0.0129 0.1714 0.1122 0.0985

#> 8 0.0360 0.0276 0.0117 0.0098 0.0620 0.0535 0.0403

#> 9 0.0655 0.0567 0.0041 0.0075 0.0974 0.0642 0.0561

#> 10 0.0459 0.0397 0.0042 0.0061 0.0691 0.0463 0.0394

#> 11 0.0228 0.0190 0.0046 0.0046 0.0366 0.0275 0.0217

#> 12 0.0329 0.0290 0.0016 0.0036 0.0483 0.0304 0.0267

#> 13 0.0175 0.0152 0.0023 0.0028 0.0268 0.0183 0.0150

#> 14 0.0131 0.0113 0.0017 0.0021 0.0200 0.0136 0.0111

#> 15 0.0141 0.0126 0.0008 0.0016 0.0207 0.0128 0.0111

#> ip_electric ip_machinery ip_paper ip_plastic new_cars orders

#> 1 0.5388 0.4469 0.3636 0.4959 0.0648 0.3823

#> 2 0.1468 0.1016 0.1557 0.2079 0.0137 0.1856

#> 3 0.0934 0.0656 0.0923 0.1255 -0.0016 0.1265

#> 4 0.3187 0.2689 0.2025 0.2771 0.0393 0.2079

#> 5 0.0830 0.0623 0.0727 0.0987 0.0045 0.0902

#> 6 0.1270 0.1044 0.0880 0.1201 0.0141 0.0952

#> 7 0.1438 0.1216 0.0904 0.1239 0.0171 0.0935

#> 8 0.0505 0.0403 0.0375 0.0515 0.0029 0.0458

#> 9 0.0816 0.0689 0.0515 0.0706 0.0096 0.0535

#> 10 0.0581 0.0490 0.0364 0.0500 0.0061 0.0389

#> 11 0.0305 0.0252 0.0202 0.0279 0.0023 0.0234

#> 12 0.0409 0.0349 0.0246 0.0339 0.0047 0.0254

#> 13 0.0226 0.0191 0.0140 0.0194 0.0020 0.0155

#> 14 0.0169 0.0143 0.0104 0.0143 0.0015 0.0115

#> 15 0.0176 0.0151 0.0103 0.0143 0.0019 0.0107

#> ret_turnover_defl ecs_ec_sent_ind ecs_ind_conf ecs_ind_order_book

#> 1 0.0381 0.5094 0.5126 0.5254

#> 2 0.0203 0.4927 0.5138 0.4636

#> 3 0.0069 0.3269 0.3320 0.3041

#> 4 0.0204 0.2221 0.2196 0.2391

#> 5 0.0069 0.2053 0.2094 0.1945

#> 6 0.0089 0.1398 0.1408 0.1414

#> 7 0.0087 0.0976 0.0957 0.1053

#> 8 0.0029 0.0845 0.0844 0.0817

#> 9 0.0049 0.0572 0.0561 0.0614

#> 10 0.0032 0.0428 0.0416 0.0454

#> 11 0.0015 0.0337 0.0330 0.0338

#> 12 0.0022 0.0224 0.0213 0.0250

#> 13 0.0010 0.0175 0.0168 0.0184

#> 14 0.0008 0.0127 0.0121 0.0133

#> 15 0.0008 0.0084 0.0078 0.0097

#> ecs_ind_stocks ecs_ind_prod_exp ecs_ind_prod_rec_m ecs_ind_x_orders

#> 1 -0.3060 0.3782 0.3546 0.4885

#> 2 -0.3504 0.4192 0.2736 0.4208

#> 3 -0.2248 0.2679 0.1777 0.2742

#> 4 -0.1213 0.1530 0.1701 0.2246

#> 5 -0.1395 0.1672 0.1168 0.1766

#> 6 -0.0863 0.1058 0.0932 0.1308

#> 7 -0.0522 0.0660 0.0753 0.0989

#> 8 -0.0542 0.0653 0.0508 0.0745

#> 9 -0.0309 0.0389 0.0436 0.0575

#> 10 -0.0231 0.0289 0.0319 0.0424

#> 11 -0.0199 0.0244 0.0221 0.0310

#> 12 -0.0106 0.0137 0.0186 0.0237

#> 13 -0.0093 0.0117 0.0127 0.0171

#> 14 -0.0067 0.0083 0.0093 0.0124

#> 15 -0.0036 0.0047 0.0074 0.0092

#> ecs_ind_empl_exp ecs_cons_conf ecs_cons_sit_over_next_12 ecs_cons_exp_unempl

#> 1 0.4212 0.3766 0.3036 -0.3700

#> 2 0.3662 0.3168 0.2890 -0.2953

#> 3 0.2435 0.2208 0.1963 -0.2048

#> 4 0.1929 0.1748 0.1334 -0.1753

#> 5 0.1553 0.1392 0.1225 -0.1305

#> 6 0.1134 0.1018 0.0835 -0.0990

#> 7 0.0852 0.0780 0.0590 -0.0783

#> 8 0.0659 0.0606 0.0512 -0.0575

#> 9 0.0496 0.0454 0.0345 -0.0455

#> 10 0.0369 0.0343 0.0261 -0.0341

#> 11 0.0274 0.0257 0.0206 -0.0248

#> 12 0.0204 0.0191 0.0137 -0.0195

#> 13 0.0150 0.0143 0.0108 -0.0141

#> 14 0.0109 0.0104 0.0079 -0.0103

#> 15 0.0080 0.0076 0.0053 -0.0078

#> ecs_cons_gen_last_12m ecs_cstr_conf ecs_cstr_order_books ecs_cstr_empl_exp

#> 1 0.3724 0.2204 0.1609 0.1915

#> 2 0.2827 0.1776 0.1512 0.1344

#> 3 0.2025 0.1267 0.1048 0.0981

#> 4 0.1796 0.1040 0.0711 0.0948

#> 5 0.1285 0.0797 0.0651 0.0627

#> 6 0.0994 0.0594 0.0444 0.0506

#> 7 0.0807 0.0466 0.0316 0.0428

#> 8 0.0580 0.0354 0.0275 0.0291

#> 9 0.0468 0.0271 0.0185 0.0248

#> 10 0.0354 0.0206 0.0141 0.0187

#> 11 0.0256 0.0153 0.0112 0.0132

#> 12 0.0205 0.0116 0.0074 0.0111

#> 13 0.0148 0.0086 0.0059 0.0078

#> 14 0.0108 0.0063 0.0043 0.0057

#> 15 0.0084 0.0047 0.0029 0.0046

#> ecs_cstr_prod_recent ecs_ret_tr_conf ecs_ret_tr_bus_sit ecs_ret_tr_stocks

#> 1 0.1436 0.1330 0.0860 -0.0238

#> 2 0.1077 0.1385 0.0835 -0.0376

#> 3 0.0735 0.0943 0.0598 -0.0241

#> 4 0.0696 0.0558 0.0374 -0.0071

#> 5 0.0476 0.0580 0.0365 -0.0144

#> 6 0.0379 0.0373 0.0240 -0.0072

#> 7 0.0310 0.0246 0.0167 -0.0029

#> 8 0.0212 0.0237 0.0155 -0.0052

#> 9 0.0180 0.0145 0.0098 -0.0018

#> 10 0.0134 0.0111 0.0076 -0.0014

#> 11 0.0094 0.0092 0.0063 -0.0016

#> 12 0.0078 0.0055 0.0039 -0.0003

#> 13 0.0055 0.0046 0.0033 -0.0006

#> 14 0.0040 0.0033 0.0024 -0.0004

#> 15 0.0032 0.0020 0.0015 0.0000

#> ecs_ret_tr_exp_bus ecs_ret_tr_empl ecs_serv_conf ecs_serv_empl_exp

#> 1 0.1486 0.1285 0.3081 0.2446

#> 2 0.1535 0.0821 0.2812 0.1926

#> 3 0.1013 0.0455 0.1866 0.1280

#> 4 0.0626 0.0656 0.1381 0.1165

#> 5 0.0631 0.0333 0.1182 0.0831

#> 6 0.0413 0.0321 0.0836 0.0647

#> 7 0.0274 0.0287 0.0609 0.0517

#> 8 0.0255 0.0146 0.0494 0.0362

#> 9 0.0161 0.0164 0.0355 0.0300

#> 10 0.0121 0.0114 0.0265 0.0221

#> 11 0.0099 0.0068 0.0202 0.0157

#> 12 0.0061 0.0073 0.0143 0.0128

#> 13 0.0050 0.0043 0.0108 0.0089

#> 14 0.0036 0.0031 0.0078 0.0065

#> 15 0.0022 0.0029 0.0055 0.0051

#> pms_comp_output pms_comp_empl pms_pmi pms_manuf_empl pms_manuf_output

#> 1 0.3414 0.3263 0.3698 0.3868 0.3338

#> 2 0.3230 0.3038 0.3653 0.3547 0.3181

#> 3 0.2231 0.1982 0.2461 0.2406 0.2167

#> 4 0.1504 0.1449 0.1595 0.1730 0.1466

#> 5 0.1385 0.1260 0.1532 0.1511 0.1351

#> 6 0.0941 0.0886 0.1023 0.1056 0.0919

#> 7 0.0668 0.0636 0.0703 0.0766 0.0648

#> 8 0.0583 0.0520 0.0631 0.0636 0.0564

#> 9 0.0391 0.0371 0.0412 0.0447 0.0380

#> 10 0.0298 0.0275 0.0312 0.0337 0.0288

#> 11 0.0236 0.0210 0.0250 0.0260 0.0228

#> 12 0.0157 0.0147 0.0160 0.0181 0.0151

#> 13 0.0125 0.0111 0.0129 0.0139 0.0119

#> 14 0.0090 0.0081 0.0093 0.0101 0.0087

#> 15 0.0061 0.0056 0.0060 0.0070 0.0058

#> pms_manuf_product pms_serv_out pms_serv_empl pms_serv_new_bus

#> 1 0.2106 0.2777 0.2131 0.2985

#> 2 0.2185 0.2625 0.1980 0.2794

#> 3 0.1364 0.1821 0.1248 0.1908

#> 4 0.0886 0.1224 0.0948 0.1322

#> 5 0.0867 0.1129 0.0804 0.1192

#> 6 0.0578 0.0766 0.0574 0.0819

#> 7 0.0382 0.0544 0.0413 0.0586

#> 8 0.0341 0.0476 0.0328 0.0501

#> 9 0.0224 0.0318 0.0241 0.0343

#> 10 0.0163 0.0243 0.0176 0.0259

#> 11 0.0130 0.0193 0.0132 0.0203

#> 12 0.0082 0.0128 0.0095 0.0137

#> 13 0.0065 0.0102 0.0070 0.0108

#> 14 0.0046 0.0074 0.0050 0.0078

#> 15 0.0029 0.0049 0.0035 0.0053

#> pms_serv_product urx empl_total empl_tot_xc empl_cstr empl_manuf

#> 1 0.1839 -0.3076 0.3256 0.1716 0.4061 0.1826

#> 2 0.1874 -0.1154 0.1055 0.0174 0.2104 0.0241

#> 3 0.1284 -0.0809 0.0916 0.0246 0.1560 0.0290

#> 4 0.0780 -0.1748 0.1887 0.1080 0.2178 0.1136

#> 5 0.0791 -0.0612 0.0656 0.0217 0.1056 0.0247

#> 6 0.0514 -0.0749 0.0799 0.0402 0.1030 0.0430

#> 7 0.0344 -0.0791 0.0866 0.0499 0.0987 0.0524

#> 8 0.0326 -0.0338 0.0388 0.0170 0.0534 0.0184

#> 9 0.0203 -0.0451 0.0494 0.0283 0.0567 0.0297

#> 10 0.0155 -0.0327 0.0368 0.0209 0.0421 0.0220

#> 11 0.0128 -0.0186 0.0217 0.0112 0.0267 0.0118

#> 12 0.0078 -0.0221 0.0248 0.0149 0.0269 0.0156

#> 13 0.0065 -0.0130 0.0152 0.0086 0.0173 0.0090

#> 14 0.0047 -0.0097 0.0113 0.0064 0.0128 0.0067

#> 15 0.0029 -0.0095 0.0109 0.0067 0.0114 0.0070

#> extra_ea_trade_exp_val intra_ea_trade_exp_val extra_ea_trade_imp_val

#> 1 0.3718 0.4140 0.3356

#> 2 0.1063 0.1588 0.1259

#> 3 0.0579 0.1018 0.0675

#> 4 0.2189 0.2346 0.1909

#> 5 0.0551 0.0798 0.0585

#> 6 0.0870 0.1001 0.0797

#> 7 0.0981 0.1054 0.0850

#> 8 0.0327 0.0433 0.0313

#> 9 0.0556 0.0601 0.0483

#> 10 0.0390 0.0430 0.0337

#> 11 0.0199 0.0239 0.0177

#> 12 0.0276 0.0292 0.0234

#> 13 0.0149 0.0168 0.0127

#> 14 0.0111 0.0125 0.0094

#> 15 0.0118 0.0124 0.0098

#> intra_ea_trade_imp_val us_ip us_urx us_empl us_retail_sales

#> 1 0.3489 0.3098 -0.2915 0.2147 0.1911

#> 2 0.1161 0.2103 -0.1946 0.1654 0.1106

#> 3 0.0679 0.1335 -0.1266 0.1090 0.0709

#> 4 0.2017 0.1551 -0.1466 0.1031 0.0999

#> 5 0.0586 0.0908 -0.0855 0.0713 0.0497

#> 6 0.0828 0.0796 -0.0750 0.0566 0.0481

#> 7 0.0904 0.0687 -0.0652 0.0457 0.0445

#> 8 0.0331 0.0407 -0.0389 0.0312 0.0235

#> 9 0.0514 0.0396 -0.0376 0.0265 0.0256

#> 10 0.0362 0.0286 -0.0273 0.0195 0.0184

#> 11 0.0192 0.0186 -0.0179 0.0136 0.0114

#> 12 0.0252 0.0175 -0.0167 0.0114 0.0117

#> 13 0.0139 0.0113 -0.0109 0.0078 0.0073

#> 14 0.0104 0.0083 -0.0080 0.0057 0.0053

#> 15 0.0107 0.0071 -0.0068 0.0045 0.0048

#> us_ip_manuf_exp us_cons_exp us_r3_m us_r10_year m3 loans ir_long

#> 1 0.0674 -0.0084 0.1569 0.1460 0.0353 0.0683 0.1689

#> 2 0.1353 0.0719 0.2166 0.1969 -0.0517 0.0058 0.1302

#> 3 0.0845 0.0388 0.1185 0.1035 -0.0302 -0.0128 0.0997

#> 4 0.0137 -0.0215 0.0541 0.0514 0.0345 0.0434 0.0810

#> 5 0.0499 0.0214 0.0762 0.0677 -0.0145 -0.0005 0.0616

#> 6 0.0218 0.0013 0.0443 0.0406 0.0054 0.0139 0.0458

#> 7 0.0049 -0.0109 0.0214 0.0202 0.0164 0.0186 0.0368

#> 8 0.0168 0.0043 0.0257 0.0224 -0.0017 0.0007 0.0283

#> 9 0.0033 -0.0059 0.0128 0.0120 0.0090 0.0104 0.0214

#> 10 0.0027 -0.0044 0.0085 0.0077 0.0064 0.0063 0.0166

#> 11 0.0047 -0.0007 0.0080 0.0069 0.0018 0.0016 0.0125

#> 12 -0.0005 -0.0044 0.0030 0.0028 0.0057 0.0052 0.0094

#> 13 0.0011 -0.0018 0.0029 0.0025 0.0025 0.0019 0.0071

#> 14 0.0007 -0.0015 0.0019 0.0016 0.0019 0.0014 0.0052

#> 15 -0.0007 -0.0023 0.0004 0.0004 0.0027 0.0021 0.0039

#> ir_short ir_1_year ir_2_year ir_5_year eer eer_cpi eer_ppi exr_usd

#> 1 0.2798 0.3213 0.2788 0.1809 0.1761 0.1481 0.1986 0.2221

#> 2 0.1613 0.2305 0.2313 0.1791 -0.0193 -0.0312 -0.0045 0.0415

#> 3 0.1027 0.1498 0.1581 0.1098 0.1229 0.1125 0.1320 0.1443

#> 4 0.1465 0.1581 0.1301 0.0780 0.1183 0.1027 0.1297 0.1349

#> 5 0.0723 0.0998 0.1006 0.0708 0.0578 0.0509 0.0641 0.0746

#> 6 0.0704 0.0835 0.0749 0.0490 0.0507 0.0436 0.0564 0.0624

#> 7 0.0653 0.0701 0.0579 0.0336 0.0629 0.0557 0.0679 0.0688

#> 8 0.0342 0.0443 0.0437 0.0280 0.0471 0.0433 0.0499 0.0512

#> 9 0.0374 0.0405 0.0337 0.0197 0.0364 0.0323 0.0393 0.0399

#> 10 0.0269 0.0295 0.0252 0.0142 0.0345 0.0314 0.0366 0.0360

#> 11 0.0166 0.0199 0.0186 0.0109 0.0266 0.0246 0.0279 0.0274

#> 12 0.0172 0.0177 0.0142 0.0074 0.0215 0.0195 0.0228 0.0221

#> 13 0.0106 0.0118 0.0104 0.0055 0.0179 0.0166 0.0187 0.0179

#> 14 0.0078 0.0086 0.0076 0.0040 0.0135 0.0125 0.0141 0.0135

#> 15 0.0071 0.0071 0.0056 0.0027 0.0110 0.0101 0.0115 0.0109

#> exr_gbp rxr_yen euro50 euro325 sp500 dow_j raw_mat_en raw_mat_oil

#> 1 -0.0422 0.2147 0.1997 0.2148 0.2047 0.2084 0.1874 0.2583

#> 2 -0.1312 0.0957 0.2098 0.2262 0.1758 0.1659 0.1901 0.1864

#> 3 -0.0067 0.1389 0.1172 0.1305 0.1191 0.1118 0.0746 0.1495

#> 4 0.0013 0.1182 0.0835 0.0897 0.0942 0.0989 0.0801 0.1266

#> 5 -0.0171 0.0769 0.0776 0.0853 0.0756 0.0720 0.0582 0.0919

#> 6 -0.0090 0.0599 0.0537 0.0581 0.0552 0.0554 0.0471 0.0698

#> 7 0.0068 0.0581 0.0351 0.0379 0.0418 0.0439 0.0317 0.0580

#> 8 0.0058 0.0449 0.0288 0.0322 0.0324 0.0314 0.0179 0.0435

#> 9 0.0039 0.0337 0.0205 0.0222 0.0243 0.0255 0.0183 0.0337

#> 10 0.0074 0.0292 0.0141 0.0155 0.0182 0.0189 0.0105 0.0264

#> 11 0.0063 0.0224 0.0106 0.0120 0.0136 0.0136 0.0059 0.0196

#> 12 0.0053 0.0174 0.0072 0.0079 0.0101 0.0109 0.0059 0.0152

#> 13 0.0053 0.0140 0.0051 0.0058 0.0075 0.0077 0.0027 0.0115

#> 14 0.0041 0.0105 0.0036 0.0041 0.0054 0.0056 0.0018 0.0084

#> 15 0.0036 0.0082 0.0023 0.0026 0.0040 0.0043 0.0015 0.0065

#> raw_mat_gold raw_mat_oil_fwd raw_mat

#> 1 0.0669 0.2083 0.2113

#> 2 0.0036 0.1996 0.2005

#> 3 0.0460 0.1257 0.1123

#> 4 0.0426 0.0913 0.0931

#> 5 0.0227 0.0806 0.0755

#> 6 0.0191 0.0564 0.0558

#> 7 0.0222 0.0397 0.0396

#> 8 0.0168 0.0326 0.0290

#> 9 0.0129 0.0232 0.0230

#> 10 0.0120 0.0169 0.0159

#> 11 0.0092 0.0129 0.0113

#> 12 0.0074 0.0090 0.0087

#> 13 0.0061 0.0067 0.0058

#> 14 0.0046 0.0048 0.0042

#> 15 0.0037 0.0033 0.0030

plot(fc, xlim = c(300, 370))

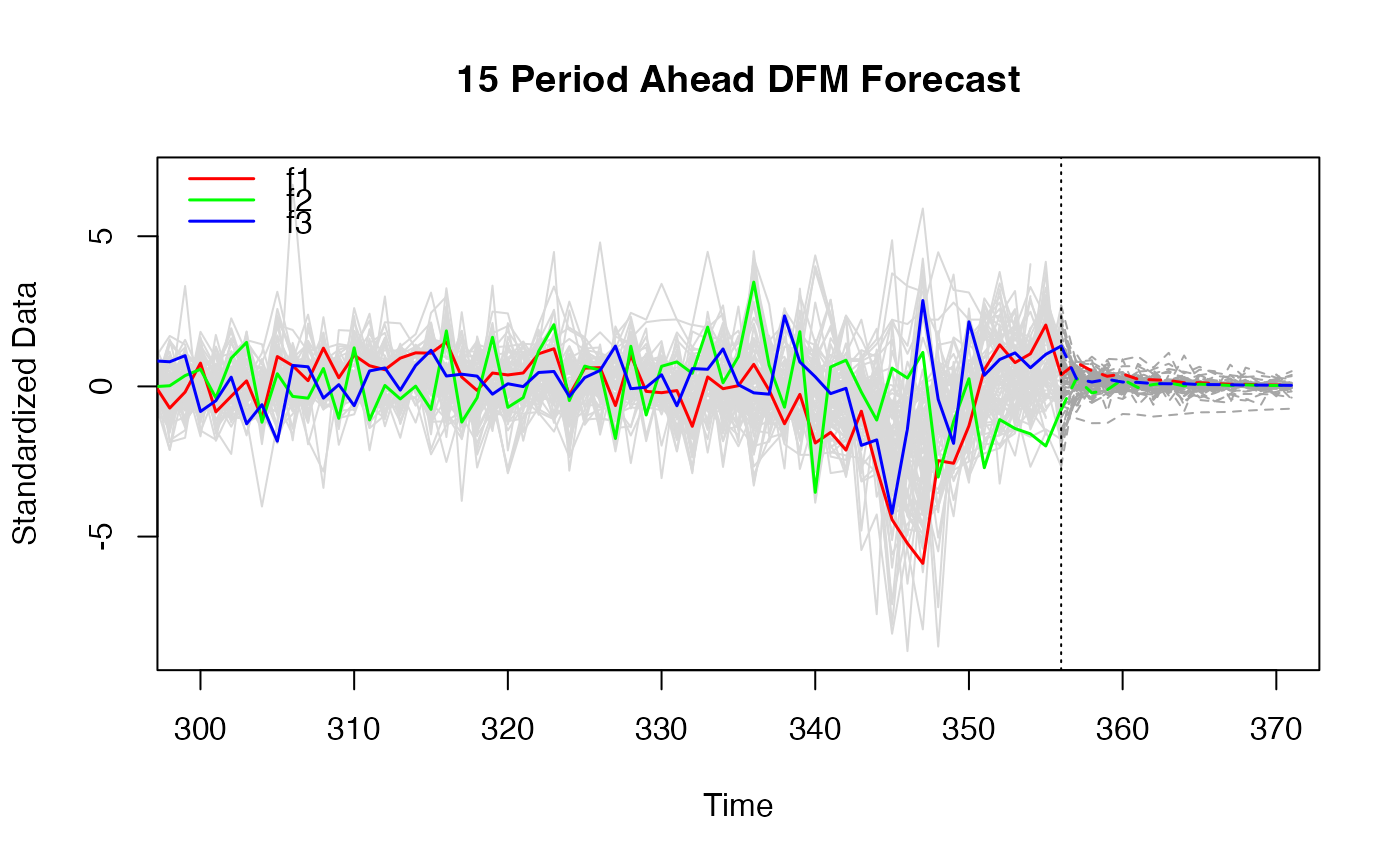

# Also forecasting autocorrelated residuals with an AR(1)

fcfun <- function(x, h) predict(ar(na_rm(x)), n.ahead = h)$pred

fcar <- predict(mod, resFUN = fcfun, h = 15)

plot(fcar, xlim = c(300, 370))

# Also forecasting autocorrelated residuals with an AR(1)

fcfun <- function(x, h) predict(ar(na_rm(x)), n.ahead = h)$pred

fcar <- predict(mod, resFUN = fcfun, h = 15)

plot(fcar, xlim = c(300, 370))

# Retrieving a data frame of the forecasts

head(as.data.frame(fcar, pivot = "wide")) # Factors

#> Time Forecast f1 f2 f3

#> 1 1 FALSE 3.0487579 -4.371719 -0.1134302

#> 2 2 FALSE -0.4236117 -2.190223 -6.3464355

#> 3 3 FALSE -9.4779810 3.824410 -2.1678243

#> 4 4 FALSE -10.8844746 6.942244 0.4569135

#> 5 5 FALSE -6.0722144 1.303051 0.7505150

#> 6 6 FALSE -1.0811737 -2.430000 1.5735378

head(as.data.frame(fcar, use = "data")) # Data

#> Variable Time Forecast Value

#> 1 ip_total 1 FALSE NA

#> 2 ip_total 2 FALSE NA

#> 3 ip_total 3 FALSE NA

#> 4 ip_total 4 FALSE NA

#> 5 ip_total 5 FALSE NA

#> 6 ip_total 6 FALSE NA

head(as.data.frame(fcar, use = "both")) # Both

#> Variable Time Forecast Value

#> 1 f1 1 FALSE 3.0487579

#> 2 f1 2 FALSE -0.4236117

#> 3 f1 3 FALSE -9.4779810

#> 4 f1 4 FALSE -10.8844746

#> 5 f1 5 FALSE -6.0722144

#> 6 f1 6 FALSE -1.0811737

# }

# Retrieving a data frame of the forecasts

head(as.data.frame(fcar, pivot = "wide")) # Factors

#> Time Forecast f1 f2 f3

#> 1 1 FALSE 3.0487579 -4.371719 -0.1134302

#> 2 2 FALSE -0.4236117 -2.190223 -6.3464355

#> 3 3 FALSE -9.4779810 3.824410 -2.1678243

#> 4 4 FALSE -10.8844746 6.942244 0.4569135

#> 5 5 FALSE -6.0722144 1.303051 0.7505150

#> 6 6 FALSE -1.0811737 -2.430000 1.5735378

head(as.data.frame(fcar, use = "data")) # Data

#> Variable Time Forecast Value

#> 1 ip_total 1 FALSE NA

#> 2 ip_total 2 FALSE NA

#> 3 ip_total 3 FALSE NA

#> 4 ip_total 4 FALSE NA

#> 5 ip_total 5 FALSE NA

#> 6 ip_total 6 FALSE NA

head(as.data.frame(fcar, use = "both")) # Both

#> Variable Time Forecast Value

#> 1 f1 1 FALSE 3.0487579

#> 2 f1 2 FALSE -0.4236117

#> 3 f1 3 FALSE -9.4779810

#> 4 f1 4 FALSE -10.8844746

#> 5 f1 5 FALSE -6.0722144

#> 6 f1 6 FALSE -1.0811737

# }